Toyota Motor Corporation Common Stock (TM)

248.29

+0.00 (0.00%)

NYSE · Last Trade: Feb 17th, 7:29 AM EST

The company's vision of the transportation market is revolutionary, and the company is betting big on it.

Via The Motley Fool · February 16, 2026

U.S. Supreme Court to rule on Trump's tariffs in February; retailers like Costco and manufacturers like Toyota are fighting for refunds worth billions.

Via Benzinga · February 13, 2026

As of mid-February 2026, the energy storage sector is gripped by a singular narrative: the transition of QuantumScape (NYSE: QS) from a venture-backed research project into a tangible manufacturing entity. The stock, which has spent the better part of the last year oscillating between single-digit lows and mid-teen spikes, has

Via MarketMinute · February 13, 2026

FEBRUARY 13, 2026 — The lithium market, which spent much of 2024 and 2025 in a punishing "glut-induced" slumber, has woken up with a vengeance this month. A perfect storm of geopolitical maneuvering, aggressive new U.S. industrial policy, and a massive pull-forward in Chinese demand has sent lithium carbonate futures

Via MarketMinute · February 13, 2026

This next-gen aircraft maker has plenty of irons in the fire.

Via The Motley Fool · February 12, 2026

The inclusion positions Pony as the first pure-play robotaxi operator to join the benchmark, underscoring its expanding footprint in self-driving technology and commercialization.

Via Stocktwits · February 11, 2026

The Japanese stock market reached a historic milestone on February 10, 2026, as the Nikkei 225 index surged to an all-time high of 58,000, capping a spectacular rally that has fundamentally redefined Japan’s position in the global financial landscape. This surge, fueled by a landslide victory for the

Via MarketMinute · February 10, 2026

The Japanese political landscape underwent a seismic shift over the weekend of February 8–9, 2026, as Prime Minister Sanae Takaichi’s ruling coalition secured a resounding landslide victory in the national elections. The win provides Takaichi with a definitive mandate to enact "Sanaenomics," an aggressive expansionary fiscal policy characterized

Via MarketMinute · February 10, 2026

This stock is seen as a buy among 95% of Wall Street analysts.

Via The Motley Fool · February 10, 2026

Toyota is naming Kenta Kon as its next chief executive, with the transition set for April 1. Kon, currently the company’s CFO, will step into the top role as part of a broader management realignment.

Via Talk Markets · February 10, 2026

The Tokyo Stock Exchange witnessed a historic milestone today as the Nikkei 225 index surged past the 57,000 mark, closing at an all-time high of 57,337. The rally, which has sent shockwaves through global financial centers from New York to London, follows the landslide election victory of Prime

Via MarketMinute · February 9, 2026

Retail sentiment remained bearish on the SPDR S&P 500 ETF (SPY), while sentiment on the Invesco QQQ Trust (QQQ) slipped to neutral from bullish last week on Stocktwits.

Via Stocktwits · February 9, 2026

The move comes as the Robotaxi race heats up, with Tesla, Baidu, WeRide, and XPeng all planning major autonomous deployments this year.

Via Stocktwits · February 9, 2026

In the high-stakes world of global diplomacy and macroeconomics, traditional intelligence and polling have often struggled to keep pace with the rapid-fire shifts of the 2020s. However, as of February 8, 2026, a new class of "truth engines" has emerged as the definitive guide for investors navigating a fractured world. Prediction markets, once seen as [...]

Via PredictStreet · February 8, 2026

There's no denying that the technology being developed is the future. The question is, can this company actually adequately capitalize on this evolution?

Via The Motley Fool · February 8, 2026

Despite a monster past performance, there is a major risk investors can't ignore.

Via The Motley Fool · February 7, 2026

If humanoid robots really are about to enter the mainstream, the first signs of that trend might appear in these three stocks.

Via The Motley Fool · February 7, 2026

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

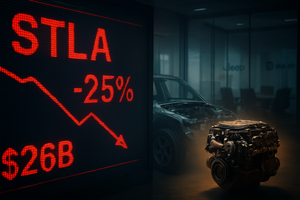

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

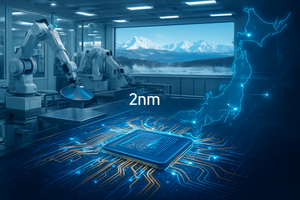

In a landmark week for the global semiconductor industry, Japan’s state-backed chip venture, Rapidus, has announced a series of critical milestones that bring the nation closer to reclaiming its status as a premier manufacturing powerhouse. As of February 2026, Rapidus has officially transitioned from an ambitious blueprint to a functional operational entity, releasing its first [...]

Via TokenRing AI · February 6, 2026

In a move that underscores the relentless demand for artificial intelligence and high-performance computing, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) has announced a record-shattering capital expenditure budget of up to $56 billion for 2026. This massive financial commitment represents a nearly 40% increase over the previous year, signaling TSMC’s intent to cement its dominance as [...]

Via TokenRing AI · February 6, 2026

Stellantis stock crashes as management announces a €22.2 billion ($26.5 billion) impairment charge. Here’s why STLA shares are not worth owning following the valuation haircut.

Via Barchart.com · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

Toyota shares rose after the automaker beat quarterly estimates and announced a leadership overhaul effective April 2026.

Via Benzinga · February 6, 2026