General Motors (GM)

81.57

-2.67 (-3.17%)

NYSE · Last Trade: Feb 9th, 2:43 PM EST

Detailed Quote

| Previous Close | 84.24 |

|---|---|

| Open | 82.27 |

| Bid | 81.55 |

| Ask | 81.58 |

| Day's Range | 80.58 - 82.40 |

| 52 Week Range | 41.60 - 87.62 |

| Volume | 5,932,675 |

| Market Cap | 73.74B |

| PE Ratio (TTM) | 25.18 |

| EPS (TTM) | 3.2 |

| Dividend & Yield | 0.6000 (0.74%) |

| 1 Month Average Volume | 9,279,774 |

Chart

About General Motors (GM)

General Motors is a leading global automotive company that designs, manufactures, and sells a diverse range of vehicles, including cars, trucks, and SUVs under various brand names. The company is committed to innovation in transportation, focusing on the development of electric and autonomous vehicles to meet the evolving needs of consumers and address environmental challenges. With a rich history in the automotive industry, General Motors also emphasizes safety, performance, and technology integration in its products while working toward sustainability initiatives and expanding its presence in the global market. Read More

News & Press Releases

In a dramatic reversal of fortune for the beleaguered electric vehicle sector, Polestar Automotive Holding UK PLC (NASDAQ: PSNY) saw its shares skyrocket by nearly 32% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $19.42, marks the company’s most significant

Via MarketMinute · February 9, 2026

Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price

Via MarketMinute · February 9, 2026

These S&P500 stocks are gapping in today's sessionchartmill.com

Via Chartmill · February 9, 2026

Unhealthy automakers have a date with a nightmare scenario if Chinese EVs sell in the U.S. anytime soon. It's also a massive opportunity -- here's how.

Via The Motley Fool · February 9, 2026

While tariff complications and EV profitability will continue to weigh on bottom lines, this automaker is still driving strong results.

Via The Motley Fool · February 8, 2026

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

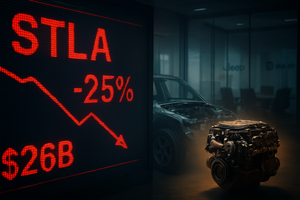

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026

GM's financial performance in 2025 cut through a lot of industry noise, and what investors need to hear is clear.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

Ford is America's oldest automaker, and it's set to potentially become its largest over the next five years.

Via The Motley Fool · February 6, 2026

Dawsonville, GA - John Megel Chevrolet, a family-owned dealership with over 25 years of experience, is excited to announce the arrival of the new 2026 Chevrolet models at its Dawsonville, GA, location. The dealership is offering a wide range of the latest models featuring advanced technology, enhanced performance, and sleek new designs. For anyone looking for new cars for sale, John Megel Chevrolet has a diverse inventory ready for customers to explore.

Via GetFeatured · February 6, 2026

This stock has been largely overlooked by investors, but the business is performing exceptionally well.

Via The Motley Fool · February 6, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

As the calendar turns to early February 2026, the global financial community is fixated on 1 First Street NE, Washington, D.C. The Supreme Court of the United States is expected to issue a final ruling in Learning Resources, Inc. v. Trump, a consolidated case that challenges the legality of

Via MarketMinute · February 5, 2026

If you're only considering dividends when comparing value returned to shareholders, you'll miss hidden gems such as General Motors.

Via The Motley Fool · February 5, 2026

The long-standing "copper supercycle" narrative faced a stark reality check this week as benchmark prices for the red metal plummeted below the critical psychological threshold of $13,000 per metric ton. On the London Metal Exchange (LME), three-month copper futures tumbled to a low of $12,650, marking a significant

Via MarketMinute · February 5, 2026

Via MarketBeat · February 5, 2026

Rivian is an innovative EV company making some neat trucks and SUVs, but is it a buy at these prices?

Via The Motley Fool · February 5, 2026

Canadian PM considering scrapping EV mandate for revised fuel standards and EV Credits, mulls EV rebate comeback.

Via Benzinga · February 5, 2026

Coffee, cars, silver, and more.

Via The Motley Fool · February 4, 2026