American Express (AXP)

337.50

-5.38 (-1.57%)

NYSE · Last Trade: Feb 15th, 11:00 AM EST

Even the Oracle of Omaha's picks can go "on sale" every now and then.

Via The Motley Fool · February 15, 2026

Via Benzinga · February 13, 2026

As the conglomerate's stake in Apple shrinks, another large holding has come to the fore.

Via The Motley Fool · February 13, 2026

Shares of American Express fell 3.1% to $342.88 on Thursday, while Spotify dropped 8.5% to $445.79 per share.

Via Benzinga · February 13, 2026

American Express’s fourth quarter was marked by a negative market reaction, as the company’s revenue and non-GAAP profit both fell short of Wall Street expectations. Management attributed the results to a deliberate shift in marketing investments toward premium products, especially the U.S. platinum card, and ongoing product refreshes across global markets. CEO Stephen Squeri emphasized that card fee growth and customer engagement remained strong, noting, “Customer demand is high, engagement is up, credit quality continues to be excellent.” Management also pointed to high retention rates and robust credit performance, despite competitive pressures and a slight sequential decline in net cards acquired.

Via StockStory · February 12, 2026

Global payments company American Express (NYSE:AXP) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 10.6% year on year to $17.57 billion. Its non-GAAP profit of $3.53 per share was 0.7% below analysts’ consensus estimates.

Via StockStory · February 12, 2026

These companies have long-term growth drivers and are resilient.

Via The Motley Fool · February 12, 2026

If you focus on these kinds of companies, the quality of your portfolio will get an upgrade.

Via The Motley Fool · February 12, 2026

Since February 2021, the S&P 500 has delivered a total return of 76.3%. But one standout stock has more than doubled the market - over the past five years, American Express has surged 173% to $354.25 per share. Its momentum hasn’t stopped as it’s also gained 16.8% in the last six months, beating the S&P by 9.1%.

Via StockStory · February 11, 2026

The financial services landscape of February 2026 has been defined by a ruthless "survival of the smartest," as the era of the fintech unicorn has officially given way to the era of the vertically integrated mega-bank. Driven by a persistent valuation reset and the desperate need for advanced artificial intelligence

Via MarketMinute · February 11, 2026

In a move that definitively reshapes the American financial landscape, Capital One Financial Corp (NYSE: COF) has announced the acquisition of fintech unicorn Brex for $5.15 billion. The deal, finalized on January 22, 2026, marks the second massive tectonic shift for the McLean-based bank in less than a year,

Via MarketMinute · February 11, 2026

The American economy finds itself balanced on a precarious ledge as of early 2026. New data from the Federal Reserve Bank of New York reveals that total U.S. household debt has surged to a staggering $18.8 trillion, a record high that reflects the growing reliance of American families

Via MarketMinute · February 11, 2026

If you're looking for good long-term stocks, the Berkshire Hathaway portfolio holdings are generally a good place to start.

Via The Motley Fool · February 11, 2026

A cash-heavy balance sheet is often a sign of strength, but not always.

Some companies avoid debt because they have weak business models, limited expansion opportunities, or inconsistent cash flow.

Via StockStory · February 10, 2026

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Mastercard (NYSE:MA) and its peers.

Via StockStory · February 10, 2026

Evercore ISI Group analyst John Pancari maintained an In-Line rating on American Express (NYSE: AXP).Pancari lowered his price target to $393 from $400.

Via Benzinga · February 10, 2026

It has been interesting to see the rise and rapid fall of certain businesses in recent years.

Via The Motley Fool · February 9, 2026

A lot of attention is being directed to the exciting things happening in the world of commerce.

Via The Motley Fool · February 9, 2026

American Express is investing in the future.

Via The Motley Fool · February 9, 2026

It can be important for investors to have a solid foundation in their portfolios.

Via The Motley Fool · February 8, 2026

American Express stock has tripled in five years. A recent premium card relaunch suggests the good times aren't over yet.

Via The Motley Fool · February 7, 2026

These stocks pay dividends, have promising growth prospects, and are all-around safer investments.

Via The Motley Fool · February 7, 2026

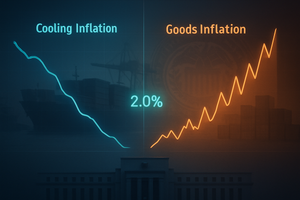

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Via Benzinga · February 6, 2026

A number of stocks fell in the afternoon session after the "AI replacement" narrative reached a fever pitch following the release of new models from Anthropic and OpenAI.

Via StockStory · February 5, 2026