Confluent’s stock price has taken a beating over the past six months, shedding 25.6% of its value and falling to $20.28 per share. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy CFLT? Find out in our full research report, it’s free.

Why Does CFLT Stock Spark Debate?

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ:CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

Two Things to Like:

1. Billings Surge, Boosting Cash On Hand

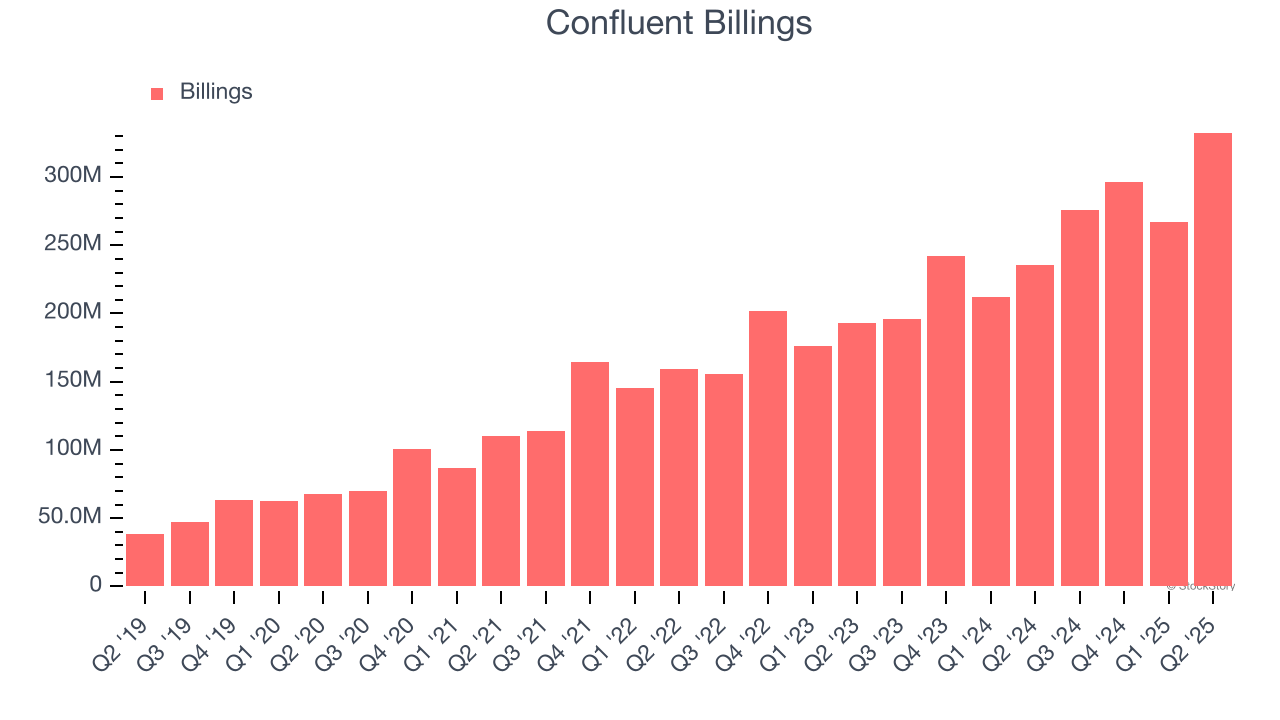

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Confluent’s billings punched in at $332.6 million in Q2, and over the last four quarters, its year-on-year growth averaged 32.6%. This performance was fantastic, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Solid Gross Margin Keeps Business on Track

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

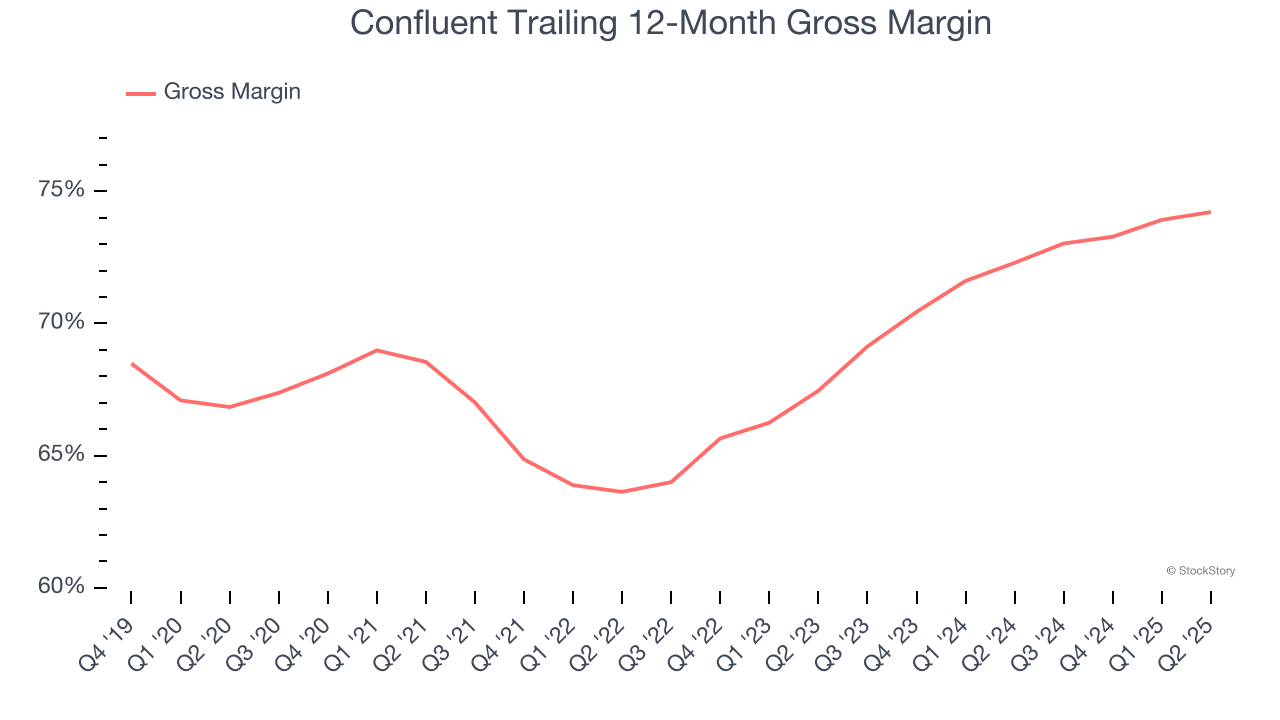

Confluent’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74.2% gross margin over the last year. Said differently, Confluent paid its providers $25.78 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Confluent has seen gross margins improve by $6.76 percentage points over the last 2 year, which is elite in the software space.

One Reason to be Careful:

Operating Losses Sound the Alarms

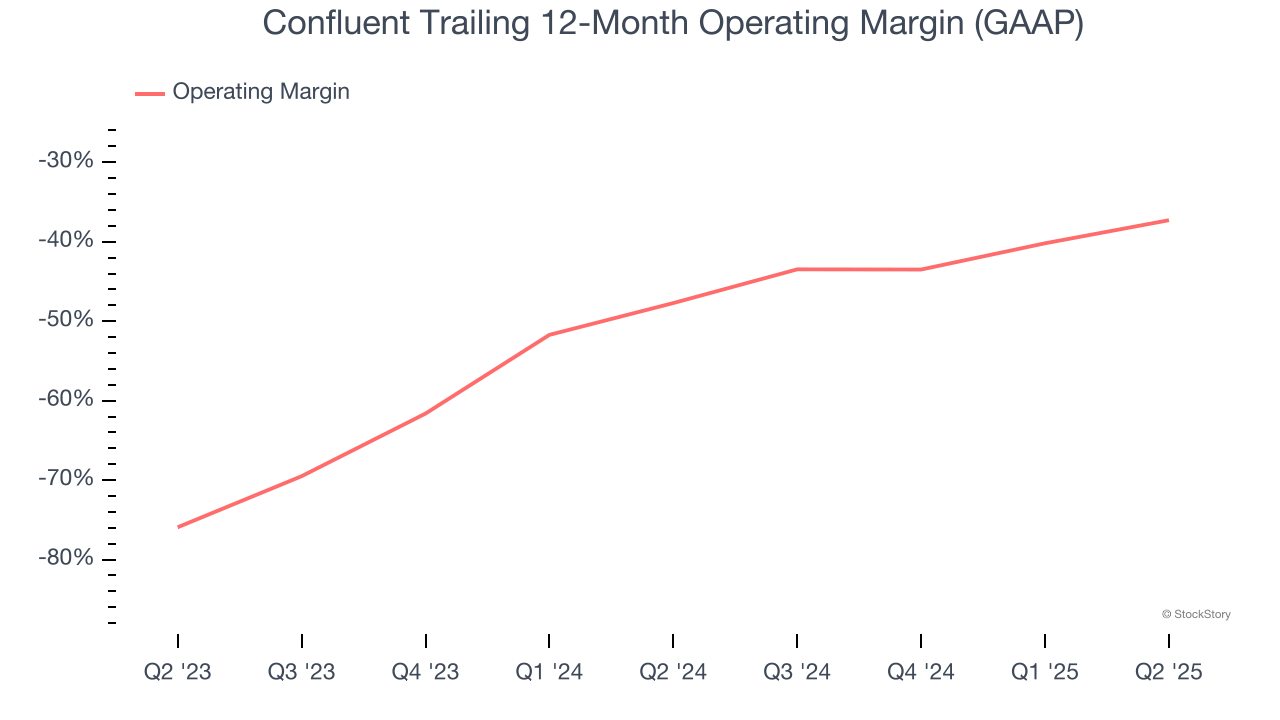

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Confluent’s expensive cost structure has contributed to an average operating margin of negative 37.3% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Final Judgment

Confluent has huge potential even though it has some open questions. With the recent decline, the stock trades at 5.6× forward price-to-sales (or $20.28 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.