Communications chips maker Qorvo (NASDAQ: QRVO) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 7.7% year on year to $818.8 million. On top of that, next quarter’s revenue guidance ($1.03 billion at the midpoint) was surprisingly good and 7% above what analysts were expecting. Its non-GAAP profit of $0.92 per share was 46.2% above analysts’ consensus estimates.

Is now the time to buy Qorvo? Find out by accessing our full research report, it’s free.

Qorvo (QRVO) Q2 CY2025 Highlights:

- Revenue: $818.8 million vs analyst estimates of $777.5 million (7.7% year-on-year decline, 5.3% beat)

- Adjusted EPS: $0.92 vs analyst estimates of $0.63 (46.2% beat)

- Adjusted Operating Income: $108.2 million vs analyst estimates of $84.31 million (13.2% margin, 28.3% beat)

- Revenue Guidance for Q3 CY2025 is $1.03 billion at the midpoint, above analyst estimates of $958.3 million

- Adjusted EPS guidance for Q3 CY2025 is $2 at the midpoint, above analyst estimates of $1.62

- Operating Margin: 3.7%, up from 0.5% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 4.8% in the same quarter last year

- Inventory Days Outstanding: 119, down from 122 in the previous quarter

- Market Capitalization: $7.83 billion

Bob Bruggeworth, president and chief executive officer of Qorvo, said, “The Qorvo team delivered a strong fiscal 2026 first quarter. We are undertaking a broad set of initiatives to structurally enhance profitability, and we are already seeing the positive effects of these strategic actions. In the September quarter, we expect sequential growth and margin expansion to be supported by increases in Qorvo content and unit volumes in large customer programs.”

Company Overview

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

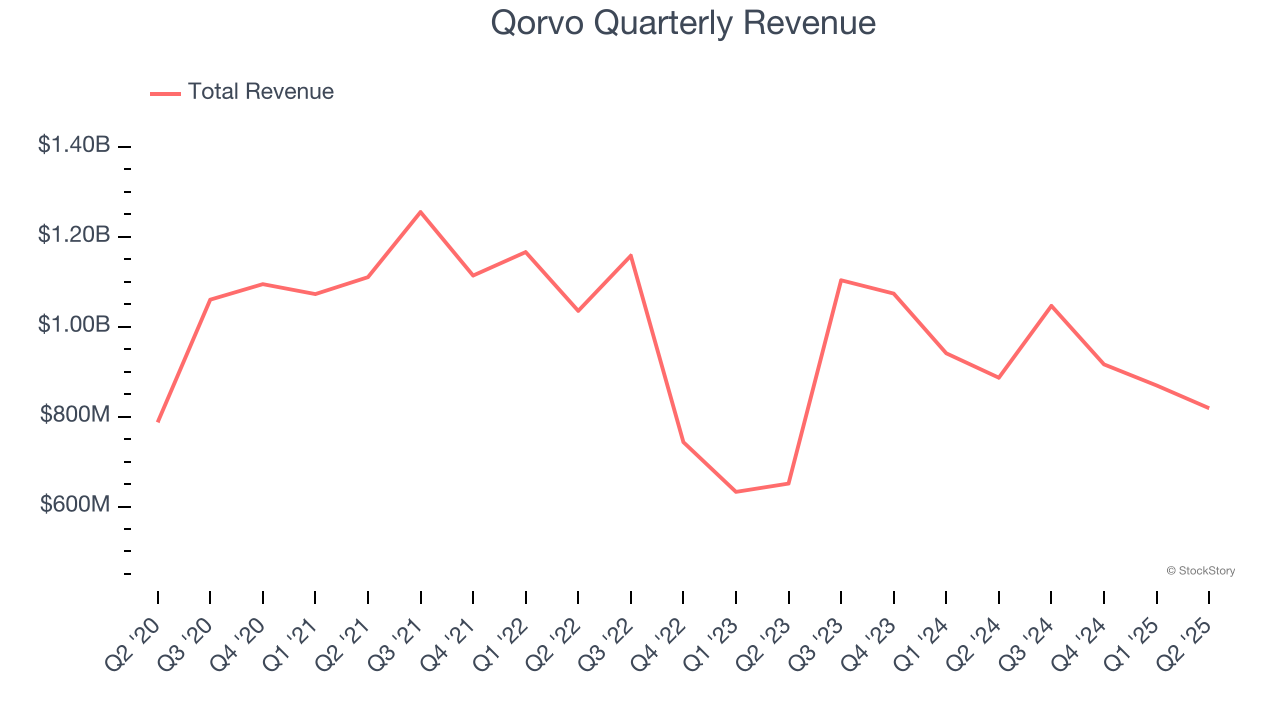

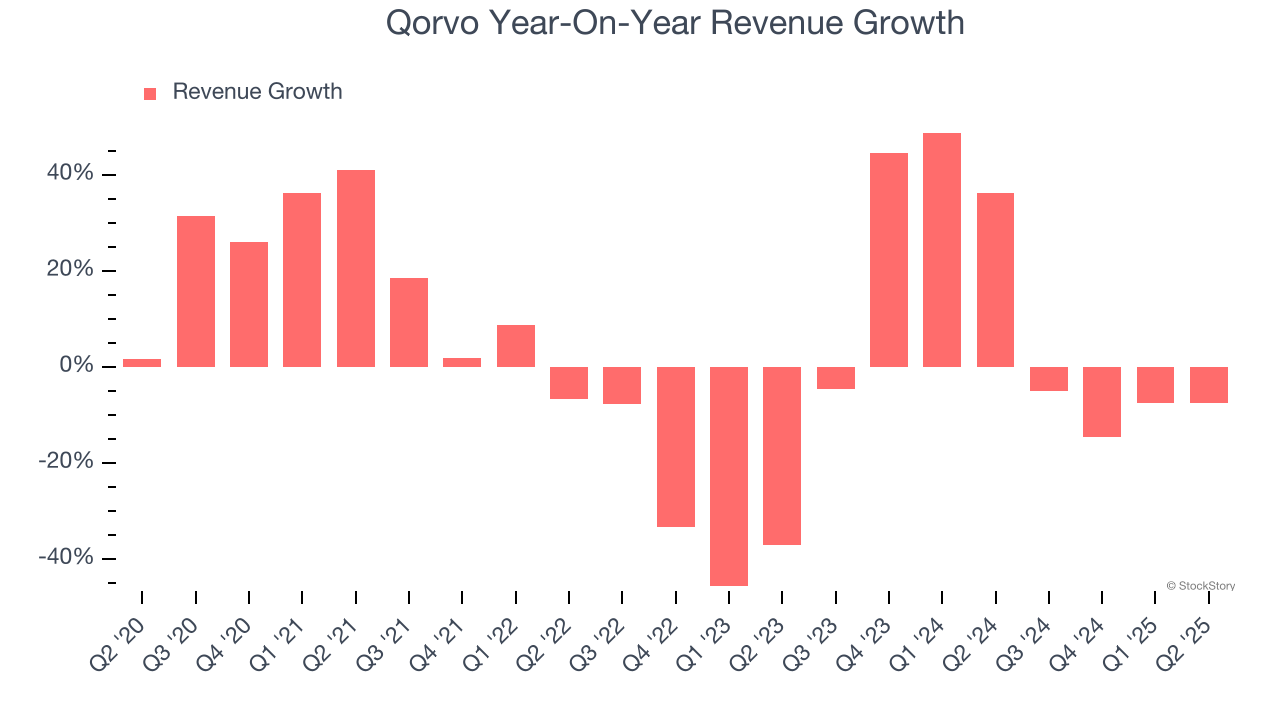

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Qorvo grew its sales at a sluggish 2.3% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Qorvo’s annualized revenue growth of 7.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Qorvo’s revenue fell by 7.7% year on year to $818.8 million but beat Wall Street’s estimates by 5.3%. Despite the beat, the drop in sales could mean that the current downcycle is deepening. Company management is currently guiding for a 2.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Qorvo’s DIO came in at 119, which is 3 more days than its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are slightly above the long-term average.

Key Takeaways from Qorvo’s Q2 Results

We were impressed by how significantly Qorvo blew past analysts’ revenue, EPS, and adjusted operating income expectations this quarter. We were also excited its quarterly revenue and EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 11.2% to $93.99 immediately after reporting.

Qorvo put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.