In 2021, Alibaba (BABA) founder Jack Ma publicly criticized Chinese regulators, sparking a massive backlash. He effectively vanished into exile for months as authorities launched an antitrust investigation into Alibaba for alleged monopolistic practices. The fallout included the scuttling of Ant Group’s planned $34 billion IPO, one of the largest ever.

Alibaba faced intense scrutiny, paid billions in fines, and restructured parts of its business. While the company has rebounded somewhat, with its stock rising over the past year amid a broader market recovery, it still trades nearly 40% below its five-year highs.

Now, Trip.com (TCOM) faces a similar regulatory storm. Beijing announced an antitrust probe into the travel giant for suspected monopolistic behavior, sending its shares down 20% since the Jan. 14 revelation, evoking fears of a prolonged “Jack Ma” treatment that could hinder growth.

About Trip.com Stock

Trip.com – formerly known as Ctrip – is China’s leading online travel agency, providing booking services for hotels, flights, train tickets, vacation packages, and tours through its platforms like Trip.com, Ctrip, Qunar, and Skyscanner. It dominates the Chinese market with an estimated 60% share when including its investments in competitors like Tongcheng and eLong, making it Asia’s largest by market cap at around $40 billion.

In 2025, TCOM stock rose just 4.7%, underperforming the S&P 500 Index’s ($SPX) stronger gains amid a robust U.S. market. However, it had climbed about 10% year-to-date before the antitrust announcement triggered the sharp selloff.

Valuation metrics show TCOM trading at a trailing price-earnings ratio of 10.64x, well below the travel industry average of 20x to 25x for peers like Booking Holdings (BKNG) and Expedia (EXPE), suggesting potential undervaluation. Its forward P/E of 20x implies growth if earnings rise as projected. The price-sales ratio stands at 5.20x, higher than historical averages around 4x during the post-COVID-19 recovery but reasonable given double-digit revenue growth.

Overall, these stats point to TCOM being undervalued relative to both industry benchmarks and its own history, especially with China’s travel rebound, but that was before the probe. Investors might see it as fairly valued if fines remain contained, but the low P/E suggests discounted pricing if the probe resolves favorably.

Is Trip.com Dead Money in 2026?

China’s State Administration for Market Regulation (SAMR) is investigating TCOM for allegedly abusing its dominant position through monopolistic practices, such as unfair pricing, restricting merchant transactions, and undercutting rivals with aggressive hotel discounts. Complaints from entities like the Yunnan Provincial Tourism Homestay Association highlight issues like forced exclusivity and price manipulation, echoing broader regulatory efforts to curb platform power in the digital economy.

TCOM’s prospects for 2026 appear mixed. On the positive side, Trip.com’s operations remain normal, and it has pledged full cooperation. The travel sector is booming, with inbound bookings surging over 100% year-over-year and outbound exceeding pre-COVID-29 levels, driven by Lunar New Year demand projected at 165 million to 175 million cross-border trips. Revenue grew 20% in 2025 to about $8.85 billion, with earnings up 80%, and similar momentum could continue.

However, antitrust probes like Alibaba’s dragged on for years, leading to fines up to 10% of revenue – potentially $700 million for Trip.com based on 2025 estimates – and forced behavioral changes that could erode margins or market share.

Investors might view TCOM as “dead money” short term, with shares likely range-bound for as long as six months as details emerge slowly, according to a JPMorgan analysis. Meituan (MPNGF) and Alibaba’s Fliggy could gain ground, chipping at Trip.com’s 60% control.

Yet, recovery is possible. Alibaba stabilized after paying fines, and if the penalty stays modest and focuses on compliance without disrupting its core business, TCOM could rebound by mid-year. Otherwise, prolonged uncertainty might make it wiser to pass, especially with geopolitical risks to cross-border travel. The bullish case hinges on China’s stimulus sustaining demand, but caution is warranted until the probe is resolved.

What Do Analysts Expect for Trip.com Stock

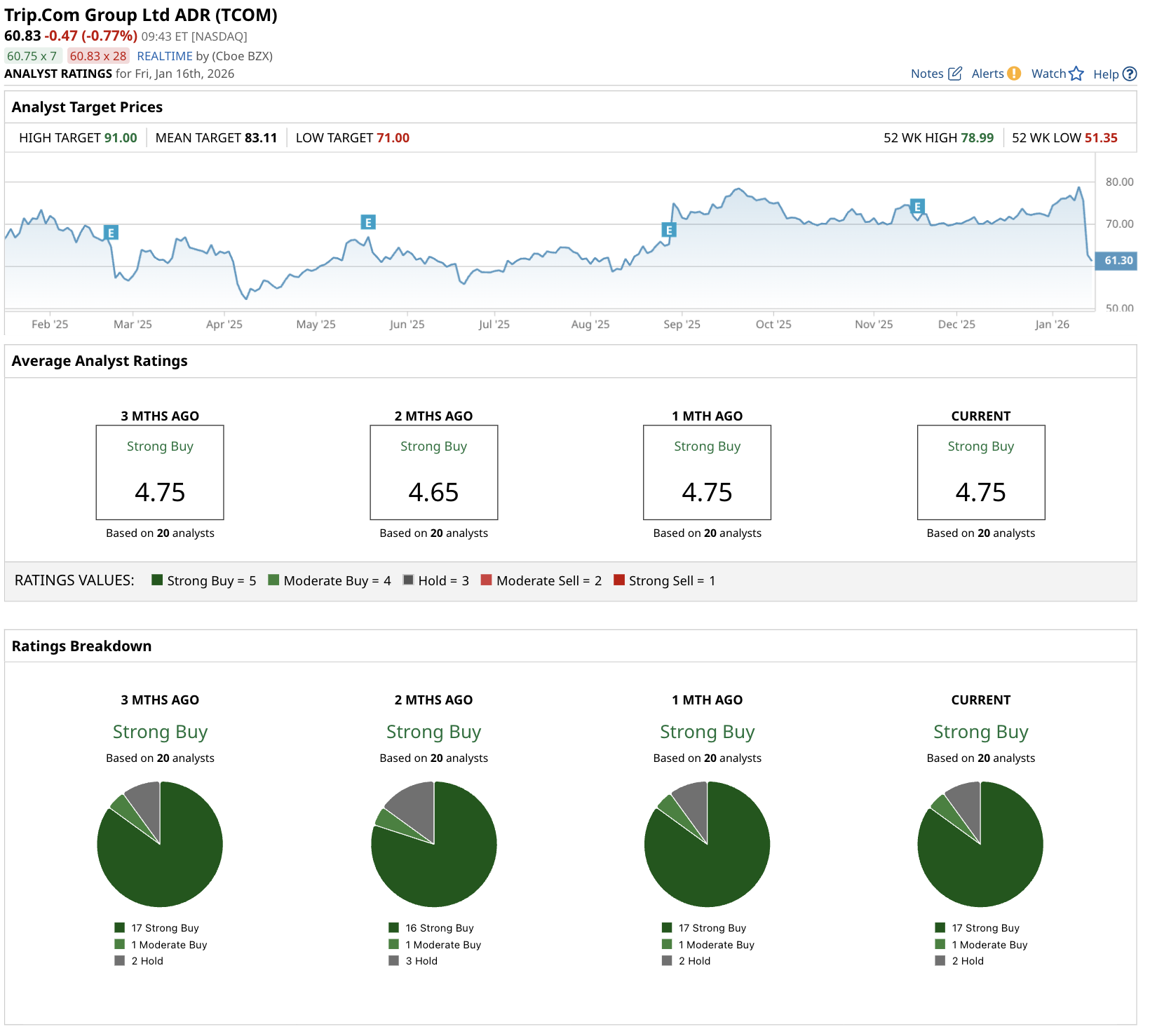

Despite the antitrust overhang, consensus analyst ratings for TCOM remain positive, with a “Strong Buy” overall. Coverage includes 20 analysts, with a breakdown of 17 rating it a “Strong Buy,” 1 a “Moderate Buy,” and 2 “Hold,” with no “Sell” ratings, reflecting optimism on travel recovery. Notable changes include Citigroup maintaining confidence, reiterating its "Buy" rating and arguing the probe won’t materially alter TCOM’s market position, though JPMorgan flagged short-term pressure. Still, it maintained an “Overweight” view. Consensus has held steady over recent months, with no major downgrades after the probe’s announcement.

Its mean target of $83.11 represents potential upside of 34%, based on the current share price around $62. This implies analysts see room for recovery if fines are contained and growth resumes, though downside risks grow if scrutiny intensifies.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Meta Platforms Looks to Double Smart Ray-Ban Glasses Production, Should You Buy, Sell, or Hold META Stock?

- Politician Gilbert Cisneros Just Sold Cameco Stock. Should You?

- 2 Top Flying Car Stocks That Cathie Wood Can’t Get Enough Of

- ConocoPhillips Has a 3.42% Annual Yield, but Short-Put Investors Can Make 1.5% Monthly