With a market cap of $68 billion, CSX Corporation (CSX) is a major U.S. freight transportation and railroad company headquartered in Jacksonville, Florida. It is one of the largest Class I railroads in North America, operating an extensive 20,000-mile rail network that serves 26 U.S. states east of the Mississippi River, the District of Columbia, and parts of Canada (Ontario and Quebec), connecting key industrial and population centers.

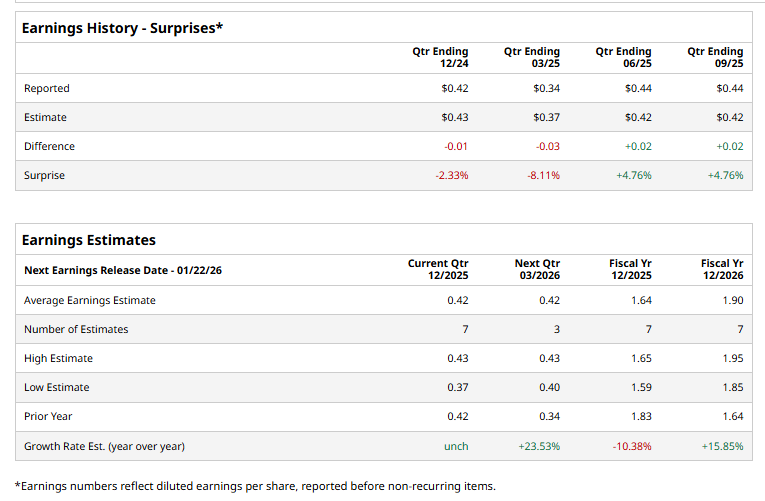

The transportation giant is set to announce its fourth-quarter results on Thursday, Jan. 22. Ahead of the event, analysts expect CSX to deliver a profit of $0.42 per share, the same as in the year-ago quarter. The company has a mixed earnings surprise history. While it has surpassed the Street’s bottom-line estimates twice over the past four quarters, it has missed the projections on two other occasions.

For the current year, analysts expect CSX to report an EPS of $1.64, down 10.4% from $1.83 reported in 2024. In fiscal 2026, its bottom line is expected to rebound 15.9% year over year to $1.90 per share.

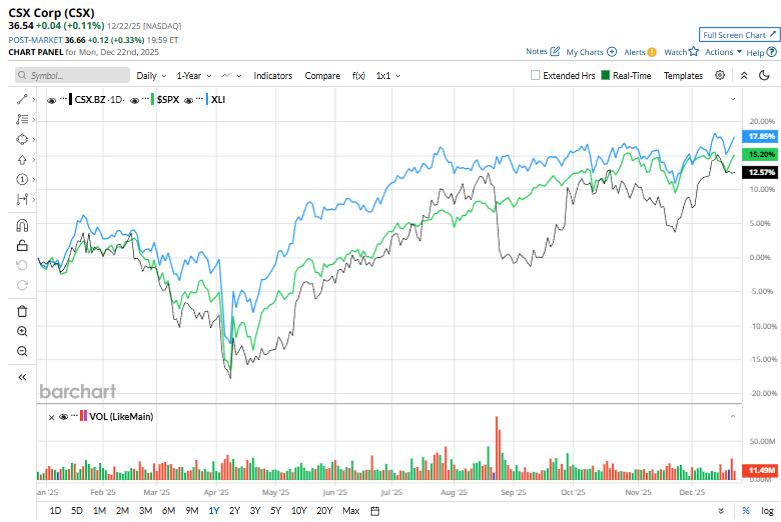

CSX shares have surged 14.7% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16% returns and the Industrial Select Sector SPDR Fund’s (XLI) 17.4% gains over the same time frame.

On October 16, CSX Corporation reported its third-quarter results, and the stock rose 1.7% in the following session. The company delivered adjusted EPS of $0.44, beating Wall Street expectations, even as revenue of $3.59 billion came in slightly below forecasts. Freight volumes posted modest growth, driven primarily by continued strength in intermodal traffic, supported by steady container and trailer movements across CSX’s rail network. That said, adjusted operating income slipped to $1.25 billion, pressured by higher operating expenses and ongoing investments in infrastructure and service enhancements.

Analysts remain optimistic about the stock’s longer-term prospects. CSX maintains a consensus “Strong Buy” rating overall. Of the 25 analysts covering the CSX stock, opinions include 17 “Strong Buys,” two “Moderate Buys,” and six “Holds.” Its mean price target of $39.50 suggests an 8.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart