Palantir Technologies (PLTR) has once again showcased strength with its financials, posting impressive growth and significant operating leverage in its latest quarter. The surging demand for its Artificial Intelligence Platform (AIP) continues to drive revenue expansion at an accelerating pace. This momentum has translated into strong profitability with the company reporting its highest-ever adjusted operating margin in the third quarter, reflecting the benefits of strong sales execution and growing customer adoption.

Thanks to the favorable demand trends, Palantir has once again raised its outlook for 2025, signaling confidence in sustained growth ahead.

Yet, despite the stellar quarterly performance, Palantir stock has struggled to maintain momentum after the earnings announcement. Instead of rallying on another beat-and-raise quarter, shares pulled back from recent highs. This suggests that expectations were already sky-high, and the market appears to have factored in the company’s strong performance. Compounding this is the fact that Palantir’s valuation remains stretched, leaving little room for error.

The company’s fundamentals remain strong, with its AI-driven growth story intact and its profitability improving. However, the premium valuation suggests that investors might need to tread carefully. So will Palantir’s strong execution and dominance in the enterprise AI software space justify its extremely high valuation?

Palantir’s Commercial Surge Unlocks Strong Growth and Profitability

Palantir Technologies delivered a blockbuster third quarter, with results that underscored the company’s growing dominance in the commercial sector and its ability to convert sales momentum into operating leverage. Revenue climbed 63% year-over-year and 18% sequentially to reach $1.18 billion, driven largely by a surge in its commercial segment.

The commercial business has become the company’s biggest growth engine, with revenue soaring 73% from the same period last year and 22% sequentially to $548 million. This was PLTR’s fourth straight quarter in which commercial revenue surpassed its U.S. government business.

A major highlight was Palantir’s total contract value (TCV) bookings, which reached $1.4 billion, representing a 132% year-over-year increase and a 32% sequential growth. Palantir’s AIP continues to be a catalyst for customer expansion and new client wins, particularly in the U.S. market. U.S. commercial revenue more than doubled, surging 121% year-over-year and 29% sequentially to $397 million.

Overall, Palantir reported its strongest quarter ever for total TCV bookings, reaching $2.8 billion — a 151% increase from the prior year. The customer base grew 45% year-over-year and 7% sequentially, reaching 911 clients. Revenue from its largest accounts also continued to rise, with the top 20 customers generating an average of $83 million each over the trailing 12 months, representing a 38% increase from the previous year. Palantir’s net dollar retention rate improved to 134%, a 600-basis-point increase quarter-over-quarter, reflecting both customer stickiness and growth.

Looking ahead, Palantir anticipates that the momentum will continue. The company raised its 2025 guidance for U.S. commercial revenue to exceed $1.43 billion, implying growth of at least 104%.

Profitability is also improving rapidly. Palantir achieved a record adjusted operating margin of 51% in Q3, up sharply from 38% in the same quarter a year earlier, reflecting economies of scale. Supported by this strong performance, management lifted its 2025 adjusted operating income forecast to between $2.151 billion and $2.155 billion, and its adjusted free cash flow outlook to a range of $1.9 billion to $2.1 billion.

In short, as its commercial business accelerates, AIP adoption broadens, and margins expand, the company is transitioning from a government-focused contractor to a diversified AI company with strong long-term earnings potential in the commercial space.

Is PLTR Stock a Buy Now?

The rapid adoption of its AIP is driving strong revenue growth, supported by an expanding customer base and a steady stream of new contracts. These factors position Palantir to deliver impressive growth in the quarters ahead.

However, while the company’s growth outlook remains solid, its valuation raises concerns. Palantir stock trades at a staggering price-sales ratio of approximately 157.9 times, significantly higher than that of most of its peers. Furthermore, its forward price-earnings ratio of 416.7x suggests that much of the optimism surrounding the company may already be reflected in the stock price.

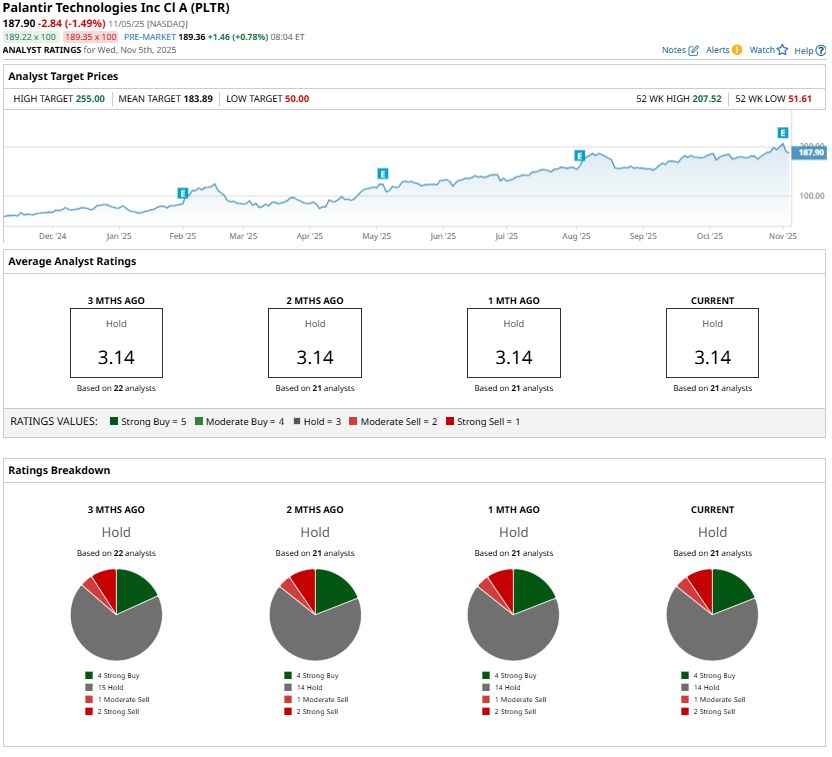

Analysts are cautious, maintaining a consensus “Hold” rating on PLTR stock. In essence, Palantir represents a high-growth story with significant long-term potential, but its current valuation leaves little room for error. Investors may find a more attractive entry point if the stock experiences a meaningful pullback.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?

- Should You Buy the Post-Earnings Dip in Axon Stock or Stay Far, Far Away?