The consumer staples sector has not done well in 2025, dropping 7.5% over the last six months while the S&P 500 ($SPX) has climbed 18%. Big packaged food names like General Mills (GIS) have dropped 27% so far this year, and Kraft Heinz (KHC) is down 22% as these companies deal with stubborn inflation and changing shopping habits.

In this kind of market, investors looking for steady income still want stocks they think are safe and pay a meaningful dividend, and Conagra Brands (CAG) shows up near the top of that list. The Chicago-based packaged foods company has a market cap of $8.2 billion and currently pays out $1.40 per share each year, which gives it a yield of 8.18%.

That’s a huge jump over the consumer staples sector average and nearly seven times the S&P 500 ($SPX) at 1.3%. Shares have fallen more than 10% just in the last month and have not kept up with the broad market, but analysts are still interested because of Conagra’s strong brands and reliable dividend.

With Conagra trading at levels not seen in years while offering one of the highest yields on the market, can this out-of-favor dividend stock really deliver the kind of steady income Wall Street expects? Let's take a closer look.

How Conagra’s Financials Back Its Big Yield

Conagra Brands is a major U.S. packaged foods company that makes everyday items found in grocery aisles and freezers, from frozen meals and snacks to condiments and pantry staples.

Over the last year, CAG stock has moved a lot. It is down 40% over the past 52 weeks, and in 2025, it has bounced from a year-to-date (YTD) high of $28.51 in March to a 10-year low of $11.60 yesterday and currently sits about 39% YTD.

On valuation, the shares look cheap next to peers. The forward P/E is 9.72x versus the consumer staples average of 15.97x, suggesting the market prices in a discount to its earnings power. For income, the appeal is clear.

The annual dividend is 8.19%, well above the 1.89% sector average, backed by a forward payout ratio of 75.02%. The company pays $0.35 per share each quarter and has raised the dividend for five straight years, with the most recent payment on October 30, 2025.

Recent results show pressure in the near term but signs of discipline. Quarterly net sales fell 5.8% to $2.6 billion, with organic sales down 0.6%. Adjusted EPS was $0.39, down 26.4%, and reported EPS was $0.34. Margins were softer, with an adjusted operating margin of 11.8% and a gross margin of 24.4%. Net interest expense fell 11.4% after paying down debt, helped by more than $400 million in divestiture proceeds, which supports balance sheet health and, in turn, the dividend.

What’s Powering Conagra’s Steady Growth

Through Conagra’s collaboration with Bloom Energy (BE), the company is integrating fuel cell technology at its Ohio production facilities in Troy and Archbold. The 15-year power purchase agreement will deploy about six megawatts of combustion-free electricity, meeting roughly 70% to 75% of both facilities’ power needs. This shift will reduce greenhouse gas emissions by nearly 19%, aligning with Conagra’s 2030 science-based reduction targets validated by the Science Based Targets initiative.

In its portfolio management efforts, Conagra has completed strategic divestitures of smaller legacy brands like Chef Boyardee, Van de Camps, and Mrs. Paul’s. The proceeds, which trimmed net debt by more than 400 million dollars in the first quarter of fiscal 2026, free up capital for reinvestment in core, higher-growth segments that drive profitability and brand strength.

The company is also adapting to changing consumer preferences by phasing out FD&C artificial colors from its frozen product portfolio by the end of 2025. It will halt sales of colored products to K-12 institutions by the 2026-2027 school year and extend the phase-out across its retail lineup by 2027, aligning with national health-focused initiatives and reinforcing consumer trust in its products.

Why Wall Street Sees More Upside for CAG

For fiscal 2026, Conagra expects its organic net sales to be flat to down 1%, with adjusted operating margins in the range of 11.0 to 11.5 percent. The company also forecast adjusted earnings per share between $1.70 and $1.85, setting a practical outlook given ongoing cost challenges and volume pressure, while leaving room to improve through better execution. This cautious but steady tone is reflected in the latest analyst feedback.

Morgan Stanley’s Megan Alexander kept a “Hold” rating in October with a price target of $21. She noted that cost pressures persist, but fundamentals are improving, signaling the business is stabilizing even as inflation and tariffs continue to weigh. UBS also maintained its “Hold” rating with a $19 target, pointing to a low bar entering the first quarter and limited near-term catalysts as organic sales remain slightly negative and EPS faces pressure.

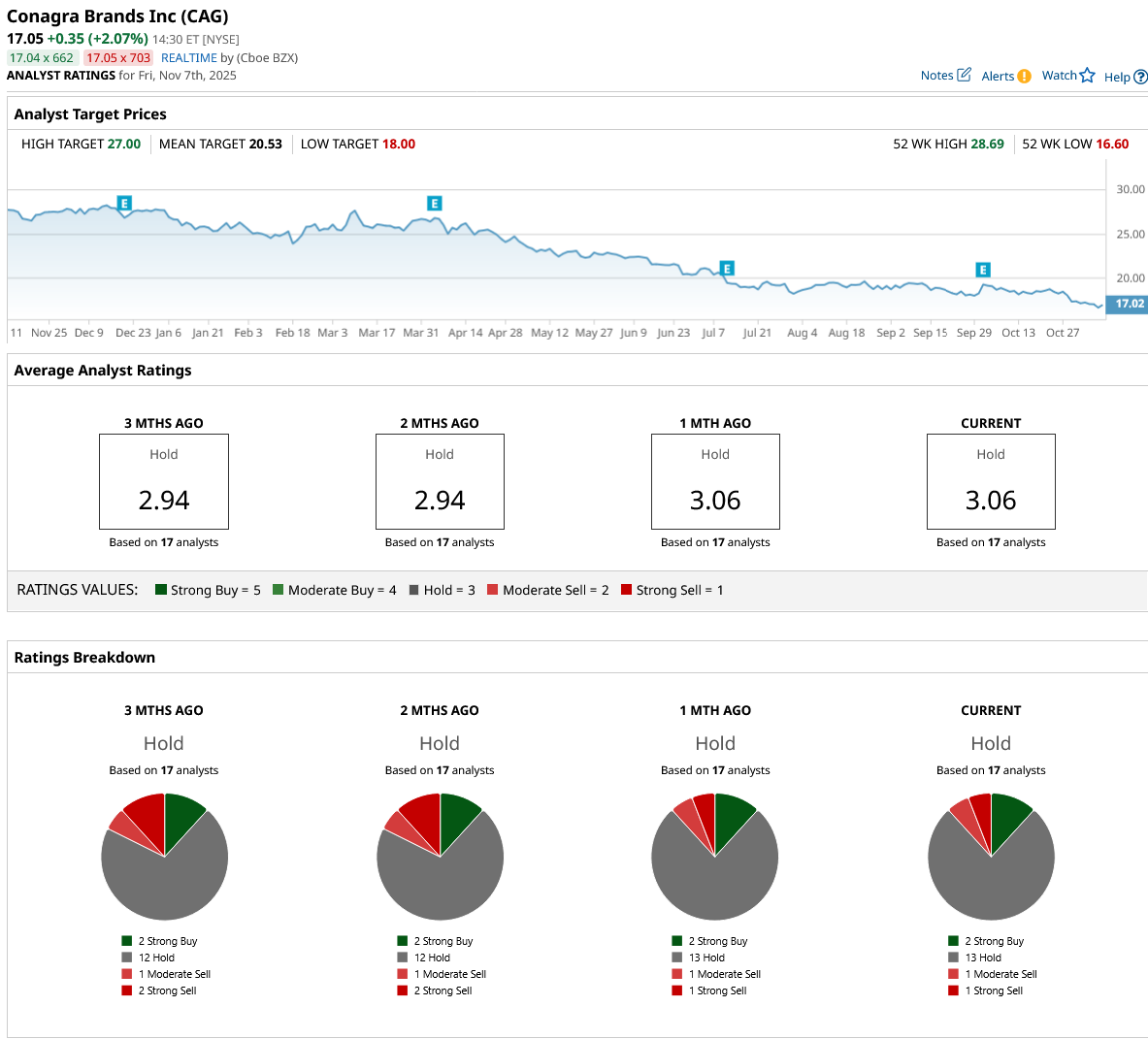

This underscores confidence in Conagra’s resilience rather than expecting rapid growth. Overall, the 17 surveyed analysts rate the stock a consensus “Hold,” with an average price target of $20.53. This suggests about 20% upside, offering a reasonable chance for price gains to complement its high dividend yield.

Conclusion

Conagra’s yield is impossible to ignore, especially for anyone prioritizing income in tough market environments. The stock offers a steady payout at multi-year lows, and with analysts forecasting about 20% upside from here, the risk/reward tilt looks appealing for investors who can stomach some near-term volatility. Given the company’s disciplined approach to its portfolio, sustainability moves, and a management team focused on defending margins, shares are most likely to grind higher as Conagra keeps proving its dividend is one you really can count on.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Stock Yields More Than 8% and Analysts Say You Can ‘Count on It’ Here

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?